Sustainability is an integral part of 1291 The Swiss Investment Foundation. We are convinced that incorporating sustainability criteria into the value chain is crucial for the success of our business activities. For both investment groups, Real Estate Switzerland and Sustainable Real Estate Projects Switzerland, we use an integrated sustainability approach to manage our investment vehicles and pay close attention to their economic, environmental and social aspects.

A transparent implementation of our sustainability strategy is ensured through established governance with our Foundation Board, Executive Management, and the Sustainability Committee. This enables us to live up to our stakeholders’ expectations. In addition to established ESG goals, we value the development of our employees, satisfaction, health and well-being. We consider social and regulatory developments to significantly contribute to resource conservation and climate protection, thus ensuring sustainable and value-oriented growth for our investors.

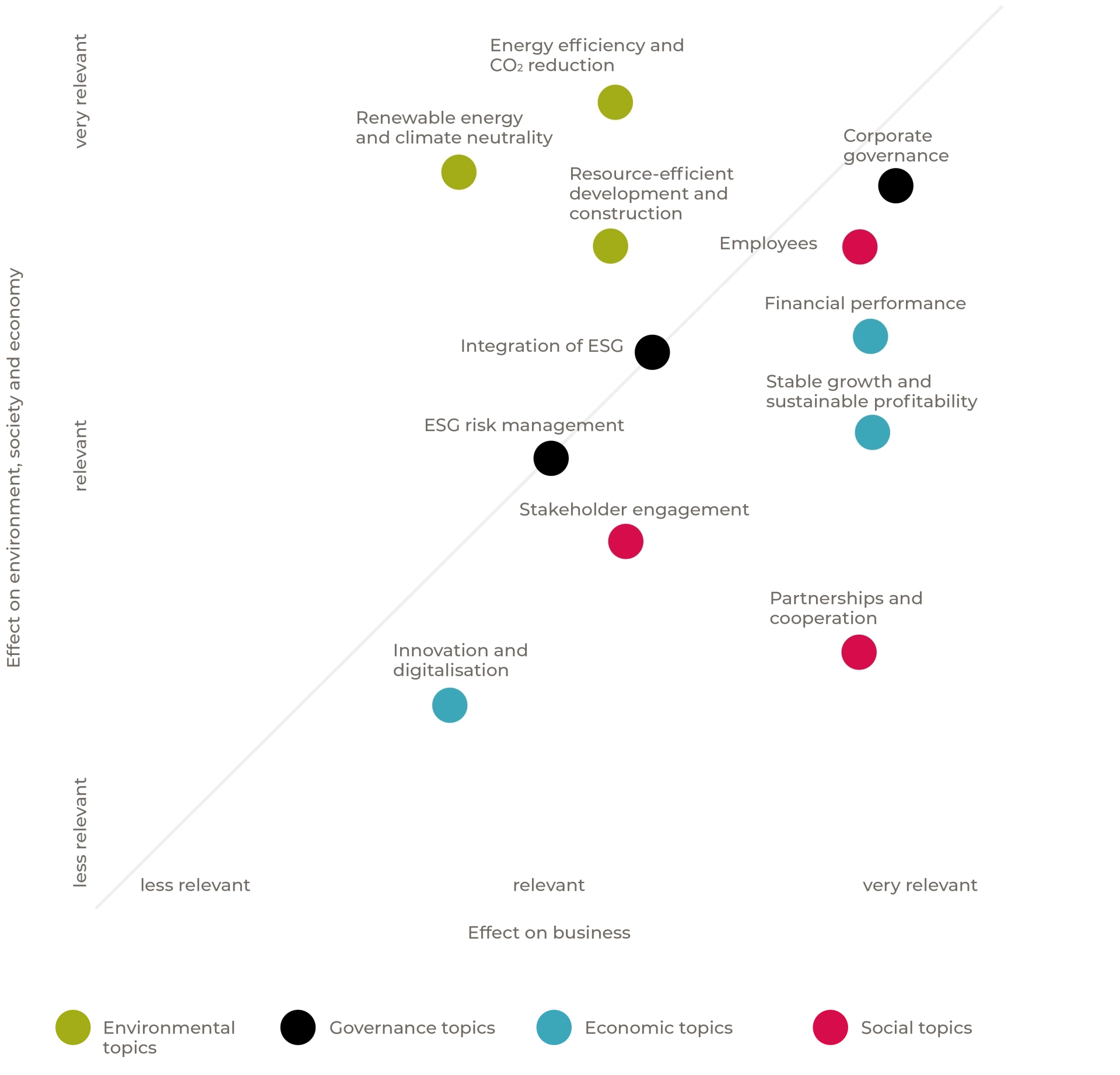

Key topics

1291 The Swiss Investment Foundation identifies and prioritizes relevant sustainability topics and ensures the strategic management of its sustainability objectives based on a materiality analysis.

UN Sustainable Development Goals

1291 The Swiss Investment Foundation aims to meet a selection of the UN’s sustainable development goals (SDGs). The following SDGs are at the forefront of our activities and govern how we manage our business.

We aim for sustainable and profitable growth while managing our business responsibly, ensuring good working conditions, communicating transparently and managing risk adequately.

We are committed to developing sustainable cities and communities, contributing significantly to sustainable living spaces, and designing and developing attractive neighborhoods that promote urbanity and connectivity.

We consistently work to promote sustainable management and efficient use of natural resources to reduce waste and contribute to circular economies and sustainable value chains.

Prudent measures to optimize energy efficiency, reduce climate-damaging CO2 emissions and expand renewable energies are key aspects of our environmental goals.

We are convinced that we can reach our ambitious economic, ecological and social goals by placing our trust in our partners and working towards specific objectives. In particular, our engagement with investors, tenants and other stakeholders is a key success factor in our business activities.

Strategy, measures and goals

Our comprehensive sustainability strategy aims to incorporate the key topics for developing our business activities in the long term and includes the following:

Our overarching sustainability goals:

- Achieving the net-zero climate goal until 2050

- Optimizing energy efficiency of 20% until 2030

- Reducing CO2 emissions by 20% until 2030

- Expanding renewable energy by 20% until 2030

- Achieving 100% building certification until 2030

- Reaching 100% ESG data transparency until 2030

Our sustainability actions and performance results*:

- Expansion of the tenant survey to include commercial tenants

- Expansion and annual recertification of 95% of the portfolio with SSREI

- Implementation of operational optimizations for approx. 15% of the properties

- Portfolio optimization through centralized electricity and energy procurement

- Participation in the annual PRI reporting

- 3 Green Stars in the GRESB assessment

*Related to reporting year 2023/2024

Memberships and ratings

1291 The Swiss Investment Foundation is a signatory of the UN Principles for Responsible Investment (UNPRI), the leading investor initiative for responsible investing.

1291 The Swiss Investment Foundation participates in the Global Real Estate Sustainability Benchmark (GRESB), the leading ESG standard for real estate investments.

1291 The Swiss Investment Foundation participates in the Swiss Sustainable Real Estate Index (SSREI), a leading ESG standard for assessing the sustainability of the Swiss real estate building stock.

Publications

Code of Conduct

Success stories

IS investment group – Kemptthal

Kemptpark 40, 42

The conversion of the commercial property in the well-connected development zone in Kemptthal was completed in 2019. All work was carried out in close consultation with the heritage preservation authorities. The property’s façade and load-bearing structure were preserved, and only the interior fittings were completely updated. Power and heating are provided via geothermal probes, and solar panels were installed on the roof. Once it had been converted, the property was awarded the U.S. Green Building Council’s international „LEED Gold“ label. A 30-year lease has been agreed with Givaudan Switzerland Ltd. Together with the new „Zürich Innovation“ research laboratory, which is also located on the site, Givaudan Switzerland Ltd employs around 500 people at The Valley Kemptpark.

IS investment group – Zurich

Bellerivestrasse 11 and Feldeggstrasse 17/23

The mandate of 1291 The Swiss Investment Foundation, which is managed by NPFM, was given the go-ahead to start work on the new construction and conversion project in Zurich’s popular Seefeld quarter in May 2023 for its Real Estate Switzerland investment group. This development project will result in the creation of forty apartments and three studio spaces. The project is to be certified in accordance with the Minergie standard, and heated using geothermal probe heat pumps. Up to 40% of the power required by the building is to be met by the solar panels on the roof. Each apartment features its own private outdoor space in the form of seating, balconies, loggias or rooftop terraces. Some of the thirteen parking spaces in the underground garage have charging stations. The project perimeter also includes an interior courtyard with an area of around 800 m2. Trees and other greenery provide a pleasant atmosphere. In order to ensure good relations with the neighbours, NPFM (on behalf of 1291 The Swiss Investment Foundation) already sought out an in-person dialogue with residents during the planning phase. Information regarding the timeline and construction site installations was provided at another event.

NIS investment group – Effretikon (ZH)

Bahnhofstrasse 28

This commercial and residential building is being built in the heart of Effretikon, in the immediate vicinity of the main station. The high-rise building includes a two-floor base for public use. The base also includes a contemporary restaurant with an outdoor space. The upper floors will offer space for service companies and different types of residential units. The new „Rosenwegplatz“ plaza, featuring large-crowned trees, will offer a high-quality place to spend time and serve as a link to the future bus station and urban centre. Heat will be generated by geothermal probe heat pumps, and solar panels will be integrated into the façade. The high-rise building will be sustainable, with SNBS certification.

NIS investment group – Wil

Untere Bahnhofstrasse 1-11

The central station plaza in Wil is one of the most appealing development zones in the region. The public and private transport connections are ideal. There are shops, leisure facilities, cultural attractions and schools in the immediate vicinity. The renovation of Wil train station by the SBB will extend platform 1 the entire length of the new construction project. The new construction project is in a very central location in Wil, with direct access to the train station and good pedestrian access, and is scheduled to be completed in the spring of 2026. On the ground floor and first floor, the „Perronimo“ offers attractive and popular retail and commercial spaces. The second floor and above will feature high-quality residential units with a wide range of uses. The project is certified as a „2000-Watt Site“. Recertification as an SNBS site is currently being considered. Centrally controlled apartment ventilation is supplemented by power generation (heating/cooling/hot water) using geothermal probes and heat pumps. Electricity and hot water are also generated on the roofs using hybrid solar collectors. The corresponding mobility concept with public, subterranean bike stands promotes the use of public transport.